Arc & Co. releases real estate funding data for H2 2025

Our New Year Funding Report: July–December 2025 Review captures a pivotal moment for the UK debt and property market. Despite regulatory friction and political uncertainty, activity remained robust, with £278m deployed across 110 transactions and a lender base broader than ever before.

Our New Year Funding Report: July–December 2025 Review captures a pivotal moment for the UK debt and property market. Despite regulatory friction and political uncertainty, activity remained robust, with £278m deployed across 110 transactions and a lender base broader than ever before.

The report explores how borrowers are adapting—using bridging finance more strategically, capitalising on improving Gateway 2 timelines, and pursuing value in a market defined by selective optimism rather than excess. It also highlights shifting regional dynamics, evolving asset preferences, and why advisory expertise has become critical as deal structures grow more complex.

From sector-level insights and geographic trends to forward-looking commentary from industry leaders, this report offers a clear, data-led view of where the market stands today—and where it is heading next.

Navigating the Surge in Back-Leverage Lending

In the last 18 months, we at Arc & Co. have witnessed a striking shift in how debt funds and non-bank lenders finance individual transactions—including real estate and equity deals. One mechanism driving this evolution is back leverage: a structure that allows debt funds to borrow from traditional lenders—often banks—using their own loan exposure as collateral.

What’s Propelling the Back-Leverage Boom and Making it a Win-Win for All Participants?

1. Accelerating liquidity and new business for debt funds

Debt funds can use back-leverage to rapidly scale investments or unlock capital without deploying fresh equity, thereby improving internal returns.

This allows them to support larger, higher-leverage transactions while still offering competitive pricing to borrowers.

Once a relationship with a back-leverage provider is established, it can be scaled to finance greater volumes and larger deal sizes.

2. Stronger capital efficiency for banks

Banks increasingly favour back-leverage because it offers exposure to commercial real estate (CRE) assets without direct lending—and carries more favourable capital treatment.

By financing a debt fund’s exposure via a structured approach—such as loan-on-loan or repurchase agreements (REPO) — they reduce risk-weighted assets and liquidity requirements.

3. Improved conditions for the end borrower

Borrowers benefit from:

Lower equity contributions

Enhanced liquidity and leverage via credit funds

Streamlined execution with a single counterparty

Key Market Dynamics at Play

Wider appetite from banks

Back leverage is gaining traction in the banking sector, with many institutions already active and more preparing to enter the market especially in CRE bank lending. Momentum is building as banks expand their involvement, signalling strong growth ahead.

Falling cost of debt amidst better terms

As interest rates have eased and margins tightened, financing costs for debt funds have dropped. That makes back-leverage even more attractive for boosting return on equity.

Individual-deal focus is rare but rising

Traditional providers tend to deploy back leverage at the fund or portfolio level; what we see now is growing demand for individual deal financing. (Knight Frank)

Credible sponsors are essential

Banks demand strong, established sponsors to underwrite risk when they lend against a fund structure.

Minimum scale thresholds

Typical deal sizes are substantial—usually a min of £50m and above—to justify structuring complexity and relative cost.

Amortisation & cash sweeps

Facilities often feature reinvestment phases followed by a mortisation periods, with cash sweeps that capture loan repayments for debt servicing—something Arc & Co. carefully engineer.

Why Arc & Co. Is Uniquely Positioned

At Arc & Co., our institutional network—including deep relationships across debt funds and banks—combined with my personal expertise, allows us to facilitate these complex deal structures. We have access to a wide range of back leverage lenders securing funding not only in a for ramp up lines, but also on a single-transaction basis.

Particularly important in these deals are negotiations around security, amortisation schedules, and cash-sweep mechanics—areas where our advisory expertise adds significant value.

The Road Ahead

Back-leverage is already proving to be an important way in which private credit is changing the UK lending market. As banks, funds, and advisors like Arc & Co. refine their models, we expect this to become a mainstream tool—especially for individual CRE and equity-backed deals.

In summary:

At Arc & Co., we believe back-leverage lending represents a strategic crossroads—uniting institutional capital, bespoke structuring, and operational agility. By aligning the interests of debt funds, banks, and transaction sponsors, we’re helping clients seize opportunities while keeping a close eye on prudential safeguards.

Arc & Co. reports 108% growth YoY in arranged lending

We are pleased to publish our Annual Real Estate Funding Report 2024/25, detailing Arc & Co.’s performance for the 12 months up to 30th June 2025.

We are pleased to publish our Annual Real Estate Funding Report 2024/25, detailing Arc & Co.’s performance for the 12 months up to 30th June 2025.

Key figures:

Lending grew by 108% from £332m to £690m

A total of 218 deals were completed across the business

Lending on offices surged to £118m across 15 deals

The amount of development funding increased by 273%

London represents 42% of transactional activity by number of deals

The report breaks down loan activity across commercial, development, bridging, BTL, luxury asset and residential mortgage lending from 1st July 2024 to 30th June 2025.

Asset types are reflected as a proportion of overall lending, with residential topping the graph at 35%, but down from 48% in 2023/4.

Hotel and serviced apartments as well as office activity rose significantly for the period, and PBSA came in at 9% compared to the previous year when no deals of this kind were completed.

The growth of BTL lending was fuelled by developers becoming accidental landlords and rental yield growth improving refinancing options.

The changing appetite of the banks is driving the uptick in commercial lending—which increased by 110% in terms of loan volume—with products and rates markedly improved YoY.

Developers pivoting to the operating living sector has boosted development figures, as well as pressure on landowners to build out to realise their equity.

Adding value as a property developer: Converting commercial to residential

The landscape of the housing market and development in the UK is both multifaceted and evolving, compelling developers to tackle various legal and practical obstacles. This series, brought to you by Arc & Co. and Lewis Denley Solicitors, highlights four vital areas that every developer should focus on to make certain their projects are legally compliant and commercially successful.

Read the guide to Converting Commercial to Residential here.

The landscape of the housing market and development in the UK is both multifaceted and evolving, compelling developers to tackle various legal and practical obstacles. This series, brought to you by Arc & Co. and Lewis Denley Solicitors, highlights four vital areas that every developer should focus on to make certain their projects are legally compliant and commercially successful.

There has been a general decline in the demand for commercial retail units, which are now available at more affordable prices.

While the commercial property market has seen some recovery due to an increase in workers returning to offices, it is still not at pre-pandemic levels. This shift, combined with the rising demand for housing and the relaxation of planning rules, has made converting commercial properties into residential units an increasingly attractive prospect.

Under Permitted Development Rights (and specifically Class MA), developers can convert certain commercial premises to residential use without the need for a a full planning application. This can significantly reduce costs and timeframes for developers, making it a popular choice in the property market.

Permitted Developments (PD) can be attractive opportunities due to reduced below-ground risk and shorter build periods, providing developers quicker returns on investment.

With several landlords looking to dispose of commercial assets due to the cost of the works required to upgrade and achieve EPC targets by 2030 and strong demand from PD developers, being able to demonstrate the ability to secure funding and complete within a certain timescale can provide a competitive edge in negotiations.

These commercial to residential opportunities can present themselves in various forms including purchase of the existing commercial stock, with planning, or PD and subject to planning consent.

Read the guide to Converting Commercial to Residential here.

Adding value as a property developer: Title Splitting

The landscape of the housing market and development in the UK is both multifaceted and evolving, compelling developers to tackle various legal and practical obstacles. This series, brought to you by Arc & Co. and Lewis Denley Solicitors, highlights four vital areas that every developer should focus on to make certain their projects are legally compliant and commercially successful.

Read the guide to Title Splitting here.

The landscape of the housing market and development in the UK is both multifaceted and evolving, compelling developers to tackle various legal and practical obstacles. This series, brought to you by Arc & Co. and Lewis Denley Solicitors, highlights four vital areas that every developer should focus on to make certain their projects are legally compliant and commercially successful.

This first part in the series deals with the intricacies and legalities of title-splitting. Title splitting refers to the process of breaking a title down into smaller segments. A prevalent method for achieving this is by obtaining a freehold property and subsequently dividing it into several leasehold titles, which is frequently applied in apartment projects or mixed-use developments. Developers then issue long leases for each separate unit, which enhances the overall equity and value of the asset.

Read the guide to Title Splitting here.

Arc & Co. New Year Real Estate Funding Report - Jan 2025

Our CEO Andrew Robinson and Managing Director Edward Horn-Smith take a look at Arc & Co.'s performance in the second half of 2024 and how we're positioned for the coming months in this ever-evolving market.

We have also included insights and commentary from a range of lenders, covering three property sectors.

Our CEO Andrew Robinson and Managing Director Edward Horn-Smith take a look at Arc & Co.'s performance in the second half of 2024 and how we're positioned for the coming months in this ever-evolving market.

We have also included insights and commentary from a range of lenders, covering three property sectors.

Read the report here.

Equity Masterclass - A pivotal tool for development funding

Over the past 12 months, Arc & Co. has experienced an uptick in enquiries from developers looking to raise equity funding for their projects. This trend underscores the importance of equity investment as a pivotal tool within the development finance structure.

Dieter Kerschbaumer tackles the topic of equity funding in this detailed report, covering single and multiple scheme structures, IRRs and equity multiples, when and where to source equity providers—and much more.

Arc & Co. Summer Real Estate Lending Report

In the first half of 2024, the number of new clients we supported doubled. This was driven by an investment in the growth of our team, as well as our marketing and origination channels, but it was also a product of market shifts.

In the first half of 2024, the number of new clients we supported doubled. This was driven by an investment in the growth of our team, as well as our marketing and origination channels, but it was also a product of market shifts. Land price adjustments and interest rate stabilisation improved the viability of projects and boosted confidence in developers, professional investors and residential purchasers.

Read the report in full, complete with funding stats, lender insights, and our thoughts on the remainder of the year.

Arc & Co. New Year Real Estate Funding Report 2024

In this report, we summarise our H2 2023 performance and reflect on the funding landscape from an advisory point of view.

Welcome to the Arc & Co. New Year Real Estate Funding Report 2024.

In this report, we summarise our H2 2023 performance and reflect on the funding landscape from an advisory point of view. Arc & Co.’s managing director, Edward Horn-Smith, also shares his thoughts on what we can expect in the first half of 2024—a year that has been dubbed a long-awaited ‘reprieve’ for property developers and investors ready to reignite activity.

To read the report, click here.

Strategic preparation for future headwinds in development funding

Written by Tom Berry

The past 12 months have seen significant increases in development costs, which has forced developers to consider alternative funding solutions that they may not have previously.

Development cost increases can be first seen in the acquisition process. Covid-19, inflation and competition in the market has caused land prices to rise considerably. Inflated land pricing is causing developers to purchase expensive land which affects their profit.

In addition to this, increases in build costs have been well documented due to substantial increases in building materials. Developers are likely to find their profit margins impacted by the increases in price from their building contractors as a result.

From a lending point of view, developers will be required by lenders to increase their contingency budgets to mitigate potential cost overruns. This in turn reduces the amount of funding a developer may receive for their land purchase or construction.

Valuation’s have also been impacted by changes in the market. We have observed valuers becoming more cautious, reductions in valuation reports have become more common, as valuers respond to the threat in the sales market and risks of recession.

Thinking about the sales market, increased interest rates for mortgages have had an impact on the buyer’s ability to afford the house prices they budgeted for. In addition, the increase in the cost of the development debt which reduces the day one loan amount.

All the above factors come the same conclusion. Developers are facing a much harsher environment that will create an impact on their profits and growth. Understanding the different options in terms of finance is an advised way to prepare for any shortfalls.

If a developer faces a shortfall or simply needs more funds than a senior lender can provide, a junior debt lender is a good solution. There is some caution that should be exercised however, considering the tightening of profit margins, Junior debt can come with an expensive cost of interest which can further erode your expected profit.

The alternative solution is working with an equity partner. The right equity partner can fund development schemes up to 100% of the total cost, there would be a profit share split and a potential interest coupon to consider. However, the reduced equity saves profit erosion from high interest rates on mezzanine finance. A benefit of having a profit share, is the equity partner shares the pressure of waiting of waiting for their return with the borrower.

This gives the developer more flexibility with their own equity and cash flow, potentially allowing them to invest in an additional scheme. Arc & Co. works with several equity partners who consider partnerships with developers on a small and large scale.

Clarity and Transparency in an Uncertain Market

Written by Oliver Holden, Senior Broker at Arc & Co.

The property development sector carries plenty of variables. With land values showing no signs of abating, plus labour and material costs continuing to rise exponentially, understanding how finance is priced is one way for borrowers to protect their risk.

The cost of a typical loan facility is usually referred to as an ‘all-in’ cost of funds. ‘All-in’ refers to the two sides of an interest product, the first being the ‘margin’ which is simply the value of risk perceived by the lender, their profit & overheads and the second, the cost of raising liquidity, the price they’re charged either by private investors or institutional markets. This will take the form of SWAPs, GILTs and pre agreed coupons for fixed rates and Sterling Market indexes for variable loans such as SONIA and the Bank of England Base Rate.

The escalating cost of fixed rates is providing borrowers with a dilemma over whether to continue with a rising variable offering or risk paying a higher rate now in the hope that the variable rate surpasses this within their loan term. Depending on term, SWAP rates are currently c3% which means that a variable product offers quite a saving on a 2-year SWAP development facility. An example project with a total loan facility of £2,970,250 has a total interest cost of £242,250 over an 18-month period assuming a variable 6% interest rate. Using a higher fixed rate of 9% would increase this cost by 34% to £367,875.

Development projects accrue interest based on the funds they draw, typically referred to as an ‘S-Curve’ profile. Rising variable rates expose borrowers to increased cost at the peak of their borrowing. Specialist debt funds recognise this and offer facilities based upon IRR hurdles, giving the borrower a clear line of sight on the actual cost of a loan. They can maximise lending capabilities to give a developer the most efficient use of equity possible. Banks on the other hand will need to underwrite rising costs in the future, this will have an adverse effect on the maximum available loan amount due to the interest reserve needed to cover expected rate increases in the loan, restricting the developer.

There will always be a fixation on rate vs margin. The escalating cost of fixed rates is leaving room for value in shorter term variable rates even if they continue to rise. The base rate will need to increase a further 1.75% before it reaches current fixed levels, even then, we expect fixed rates to increase accordingly. Understanding the finance sector is critical to a client’s success, and as a multi award winning debt advisory firm, Arc & Co. are extremely well placed to help borrowers navigate the uncertain times ahead.

How has the pandemic increased demand for Build to Rent developments?

Originally published in Business Moneyfacts magazine

Written by Georgie Crocker, Broker at Arc & Co.

Historically, the UK has had a strong focus on home-ownership, however the combination of house prices increasing, Covid, Brexit, rising inflation, rising living costs etc., has resulted in many having to rent later in life. Tenant demand is rising and the private rented sector is struggling to meet it; recent Zoopla figures show that demand for rental homes in the UK is 43% higher than the five year average. The Build to Rent sector is therefore rising to fill part of this gap, accounting for 20% of all new housing in England in 2021. Tenants’ needs have changed, with a higher priority being placed on higher specification, multipurpose residential space with social living spaces. The rise of PBSA has also set high standards of living compared with the traditional house share. The sector comprises of new purpose-built properties for the modern residential rental market, offering a higher specification than most standard buy-to-lets. New figures released by global real estate advisor, CBRE, show a record investment in the UK’s Build to Rent sector of £4.1billion in 2021, £2.1billion of which was during Q4, with over 205,000 new homes completed or under development currently. Most of these Build to Rent schemes are in cities with increased housing targets.

Many believe that the pandemic forced the Build to Rent sector to react and adapt accordingly to the changing needs of renters. Renters are being more prescriptive around what they require from a home in the post-pandemic environment – work from home flexibility, proximity to amenities, community, flexibility, working space etc. Developers have raced to provide new urban schemes that offers just this, through build to rent properties that offer on-site facilities such as gyms, concierge services, 24-hour security and communal work and living spaces. Standards are generally higher than a privately rented property. As the Build to Rent sector matures, so too are the expectations of renters and investors. Build to Rent has become an established product in its own right, offering an inviting urban lifestyle which has led to it becoming an institutional grade investment. Research from estate agency Ascend Properties revealed that planning permission requests for Build to Rent units across the UK rose 52% during the pandemic – this can be attributed to the low interest rates, commercial property yielding low returns and the housing shortage making Build to Rent an attractive proposition for investors.

Clearly, the increased amenities offered with Build to Rent properties comes at a premium. Research conducted by Ideal Flatmate shows that on average, Build to Rent accommodation is 15% more expensive than a buy-to-let property or renting privately. With attitudes in the private rental sector changing post-pandemic, there has been an increase in demand for more expensive rentals with more amenities. So what does this mean for developers? BTR is an increasingly lucrative opportunity for developers and investors seeking higher rental yields from premium new build properties. Granted, purpose-built properties require a high capital investment to complete, however, developers and investors looking to maximise returns are benefitting by spending more at the outset as the increased amenities offered results in higher rental yields. To offset the risk, developers have been able to seek forward funding or formal sale due to changing appetite from institutional investors which results in a lower return for the developer but with the benefit of lower overall exposure. Other benefits of new builds include considerably lower running costs as they are typically more energy efficient and maintenance costs are reduced compared to older buildings. These qualities also make them suitable for ESG and green financial products, further increasing alignment for funding from an institutional point of view.

The majority Build to Rent investment has gone into the traditional city centre apartment blocks within urban areas, targeting young professionals. However, the British Property Federation revealed that the Build to Rent pipeline increased by 8% in 2021, with developments in regional cities significantly outdoing London. 12,000 Build to Rent homes began construction across regional cities in Q3 2021, the highest figure recorded. According to Savills, major cities such as Manchester, Liverpool, and Brighton are at the heart of the boom in investment for Build to Rent schemes. The latest figures from the BPF show there are now 88,893 Build to Rent properties in London and 116,632 elsewhere in the country. In 2022, it is expected that there will be further increases in the suburban Build to Rent market with a high percentage of deals focused on secondary cities and suburban towns, owing to demand from tenants as well as developers and investors wanting to diversify their portfolios. Increased competition for land may also play a part in this.

The Build to Rent sector clearly has a lot still to deliver and is still maturing. However, the record investment of the past two years has reflected the sector’s ability to weather the impact of the global pandemic. Renters expectations of living standards, increased appetite from institutions on funding, forward fund and formal sale makes it attractive to developers. The demand in the current post-pandemic (we hope) environment, indicates that the lifestyle offered from Build to Rent properties shows sustained growth, throughout 2022 and beyond. Where there is demand, developers and investors will continue to strive to meet it.

Why is an exit strategy so important to a development?

Written by Tom Stephenson, Asset Finance Adviser

Originally published in Business Moneyfacts magazine

With so much uncertainty in our industry, one of the most important areas in a lender’s underwriting process is to understand the exit strategy. From a developer’s point of view the obvious exit strategy is usually via sales, but longer build times, varying demand of asset class and supply chain issues have caused fluctuations within the housing market. Knowing your options and having flexibility is vital for successful investment and having a plan for the worst-case scenario is more important than ever.

What are the main options?

Exit bridge (refinance)

One of the most common exit strategies is to re finance on to an exit bridge. This is a popular route as it tends to be quick and flexible regarding asset disposal and timescales.

The market is offering some unique products which allow for cashflow modelling of a loan based on expected sales, allowing for maximum LTV and low pricing. This will allow for an equity release on a case-by-case basis depending on overall loan to value on the remaining loan facility.

Buy-to-let

The second option developers might consider is to hold onto the remaining units and place them on a Buy to Let mortgage. This is a long-term loan that is usually cheaper than an exit bridge. A long-term strategy may not suit some developers as equity is retained within the development, however there are options with no early repayment charges which could allow the developer the flexibility to sell if needed.

One of the problems that developers can experience, is that the loan to value is calculated on interest coverage ratios. If the yield isn’t high enough, it can be challenging to get enough leverage to repay the existing debt. However, there are products that exist that allow you to use the yield and assessment of the borrower’s income by the way of top slicing which could help the borrow increase the loan to value.

Blended buy to let and exit bridge

A strategy which is becoming increasingly common is for developers to split the remaining units, putting half on buy to let mortgages and half on an exit bridge. There are lenders in the market that will consider both structures. This allows the developer to retain a long-term investment while also giving them the flexibility to free up some capital for other opportunities.

The liquidity within current development finance market means there are more options available, but the right option will always depend on the client and the strategy they have for growing their business. Historically, developers have suffered from a shortage of equity and not having the option of retaining units for long term income. As the market is developing, both options are becoming increasingly viable.

Understanding the Recovery Loan Scheme

The Recovery Loan Scheme (RLS) provides financial support to businesses across the UK as they recover and grow following the Coronavirus pandemic. RLS gives the lender a government-backed guarantee against the outstanding balance of the facility.

Loans up to £10m for individual businesses, and up to £30m across a group

Loan term up to 6 years

80% Government guarantee

Businesses that have already received support under existing COVID-19 loan schemes will still be eligible to access finance under the RLS, but only if they meet all other eligibility criteria. The outstanding balance of any CBILS or CLBILS will need to be taken into consideration when determining the amount of RLS finance. In essence, the RLS is designed to improve the terms on offer to borrowers, but if a lender is in a position to offer the option of a loan on better terms than an RLS loan, they will do so.

The RLS is now open for applications and the programme runs until 31st December 2021, subject to review.

If you are interested in finding out more about the Recovery Loan Scheme, please contact Philip Kay on +44 (0) 20 3205 2191 or email: philip@arcandco.com

Expansion of liquidity in the residential development finance market

Written by Tom Berry

This time last year, the development finance market was a very different landscape than it is today. Almost 2 months into the UK’s first lock down, lending across all asset classes was hugely restricted. Fast forward to the present day and we have seen a huge influx of liquidity into the residential development finance sector in the last 6 months, as the economy continues to recover. There are a variety of factors which have led to this, helping to contribute to an increased availability of development finance.

The first, is the ongoing support the housing market receives as the main driver of the UK economy. The current conservative government has a manifesto pledge to increase supply of housing by committing to 300,000 new homes per year in the UK, with a focus on rebalancing the housing market towards home ownership. These targets have not been met in the past, so the government continually needs to find ways to stimulate the housing market and enable development across all tenures. There are several initiatives that have been introduced and improved, in order to increase UK housing stock, which in turn increases the rise in development funding we are presently noticing.

Homes England are the department responsible for facilitating residential development in order to reach the government’s target. Utilising the government’s funds, they provide senior development loans to private developers where the mainstream lenders might not. They also assist first time developers without the track record required to secure funding when more cautious lender are less permitting. More recently, they have expanded their offering by partnering with challenger banks like United Trust Bank. This allows them to provide junior debt, against the banks senior debt creating low cost of funding on an overall higher geared capital stack.

The most recent example of how the government is trying to stimulate the market is the introduction of a 95% mortgage guarantee. It is available to all types of borrower, not just first-time buyers on all properties up to £600,000. Although on the surface this may not help a wide range of borrowers as it does not increase mortgage affordability, it will allow those with a low deposit access to home ownership, and in turn, the current owners of those properties to move further up the ladder.

The availability of efficient mortage poducts has made it easier for people to buy, whether they are first time buyers or not. Facilitating this boosts the whole development cycle by supporting sales, improving perceived risk within the lending market and in turn, access to development financing.

These aren’t however the only factors affecting the noticeable changes in the past few months. One of the most obvious explanations for the recent influx of liquidity into the market is the effect the pandemic has had on the commercial sector. For over a year now, many businesses have remained closed, with offices left empty as people continue to work from home and our high streets struggling to compete with the dramatic uptake in ecommerce. In addition to the government’s initiatives helping to simulate the housing market, lenders and investors have reacted to the change in the commercial markets over the past year. Certainly for now at least, commercial investment has been deemed too risky and volatile for most lenders. As a result, lenders are opting to place their focus on more stable lending propositions and for now, that means allocating their funds into residential development products. Considering that the typical term of a residential development loan is around 18-24 months, lenders are able to mitigate the current risk associated with the commercial market until the effects felt by the pandemic stabilise. The residential development products avabliable are not only liquid but comptetive. We have noticed a rise in LTGDV and reductions in overall cost of funding, as lenders seek to utilise their capital in a more reliable space, the residential development market.

Optimistic developers may find they have more profitable schemes due to the cost efficient products available, resulting in a higher ROE for the borrower. In the first instance, the borrower will feel more secure and confident with their anticipated profit levels. Suggesting that prospecting borrowers will consider more schemes that they could do in the average year. With more liquid equity available, developers will be able to explore more opportunities than they would typically, perhaps schemes with more units, higher GDVs, enabling their overall growth.

The residential development finance market is a complex balance of different influences, and how long abundant liquidity will remain will depend on how well the economy bouces back as it gradually starts to reopen. In the short term, there is a huge incentive for developers to take on new projects, take advantage of the finance available and the uplift to their anticipated profit levels. The combination of the continuous support the housing market receives from the government and current risk associated with investment within the commercial sector has resulted in increasingly competitive finance, boosting both the developers margins and the ease at which it can be acquired. In the long term, this will have a positive effect on the finance market for both developers and lenders as those projects complete, and the capital can be recycled encouraging the growth of both the developer and lender.

Seeking Clarity

Written by Philip Kay, CFA

2020 has been a difficult year for commercial real estate. Save for the logistics market, sectors such as retail and hospitality have not fared so well. The pandemic has also sparked debate regarding the outlook of the office market, raising fundamental questions as to the productivity cost/benefit trade-off.

CRE term lenders have understandably reflected these increased risks by adapting their lending criteria accordingly. Whereas some commercial banks have withdrawn entirely from financing commercial assets, others have been lending selectively, for example against supermarkets or convenience stores or offices let on long leases to strong covenants.

Given the news of the forthcoming vaccines, could we now be at an inflection point where a return to a ‘new normal’ is in sight? And what could be the effect on lender appetite given this news?

For many assets, a short period of income stabilisation is now required before the ‘new normal’ arrives. Lenders now have an opportunity to begin lending again before it becomes easier to underwrite cashflows and there is a flood of participants back to the market.

In the case of offices, even if there is a structural shift in how offices are utilised, with flexibility in size and use being demanded by office tenants, the risk of office properties no longer being relevant appears low. For instance, investors in office blocks in strong locations which might have faced vacancies as a result of 2020, might look to use the opportunity to carry out refurbishments, safe in the knowledge that the strong location will likely generate tenant demand at the point where the refurbishment completes and life returns to normal. Accordingly, the term lender could structure their loan to account for the lack of income during the refurbishment, marketing and rent-free periods and still be confident in the levels of income in the short to medium-term. The lender would also benefit from the knowledge that their security will have increased in value following the refurbishment.

Another example is in the purpose-built student accommodation space, where construction delays during the early stages of the pandemic have resulted in new developments completing later than scheduled, leaving an income gap between when students book their accommodation in the Spring and when they begin to pay rent at the start of the academic year in September/October. In the same way, a pragmatic term lender could perhaps view this as purely a question of income delay rather than income uncertainty and mitigate this risk with cash on account to cover the lack of income for the relevant period, rather than forcing the developer/owner to take out a relatively expensive bridging facility before refinancing onto a term loan, thereby doubling up on fees.

As the horizon for post-Covid normalisation approaches, the market appears to be finding clarity on the direction of travel. Commercial lenders are selectively adapting their product offering but a more pragmatic approach in assessing risk exposure is needed to support the recovery in the commercial market into 2021.

First published in Buisness Moneyfacts Magazine

For any further information, please contact:

Philip Kay, CFA

Senior Asset Finance Advisor

T: +44 (0) 7894 872 667

Debt for Residential v’s Commercial Assets and the Change in Demand.

In March, no one could have predicted exactly how or how long the property market would be affected as a result of Covid-19. When estate agents re-opened in May, a tsunami of residential transactions followed which lasted for months. Pent up demand coupled with a revolt of city folk leaving for housing with green open space meant that July and August saw sales volumes not seen in decades.

The commercial real estate market however tells a different story. With most people working from home, great swathes of commercial real estate have been left empty and questions are being asked about its future. The hospitality sector has been the hardest hit whilst retail has been struggling for years. In contrast, the pandemic has rapidly shifted consumer habits in favour of online shopping which has supported the industrial property market with a greater need for primary distribution hubs and a web of secondary interconnecting logistics centres.

The biggest difference between these markets is that the residential market is underpinned by the value of the home whereas commercial assets are underpinned by the value of the lease and the strength of the company behind it. The result is that most of the commercial property market has become a less attractive investment opportunity whilst companies struggle to survive, therefore providing less certainty, which in turn drives down the return and increases the risk. Simply put, investment yields have been pushed out, property values have fallen and existing banking covenants have been put under pressure if not into default, putting more responsibility onto the landlord to service the debt and make whole the banking agreements.

What is interesting is how the debt markets are responding, not only in the way that risk is perceived but who is participating within these individual markets and their appetite. In line with the strong residential shift, many debt lenders are back to full lending capacity with both leverage and price supporting residential led development, particularly those focussing on housing instead of flatted schemes. In comparison, the commercial sector is struggling with many lenders not choosing to lend or lending with greatly reduced leverage to reflect the risk in the businesses behind the lease and therefore the underlying value.

As a result of these mechanics, we have seen a shift in existing commercial lenders coming into the residential debt space in order to balance their market exposure and loan books to find a return on their capital in the near term. Overall, the residential market is realising the benefit of the current conditions with more liquidity being attracted from both the UK and Europe. This in turn is developing the products available on the market as new liquidity is trying to find its competitive edge.

First published in Buisness Moneyfacts Magazine

For any further information, please contact:

Julian King

Asset Finance Adviser

E: julian@arcandco.com

T: +44 (0) 20 3205 2190

Market View: Purpose Built Student Accommodation

Written by Matthew Yassin

The PBSA market has recently seen fundamental changes in the way it is being viewed by lenders and institutions alike. It was traditionally viewed as an attractive long-term investment and there were many options for the developer to consider, forward fund/purchase, development finance or joint venture. We have seen institutions withdrawing from the market because of the lack of confidence in the demand section of the chain. A concern is that there may be an oversupply of PBSA beds within the market. Some of the points of contention are: How many UK and overseas students will take up the new supply of beds? Will they want to travel in this climate? Is current government advice prohibiting people from making decisions? Will there be a long term rise in online learning? The concern is that the demand will not meet supply considering PBSA is heavily reliant on overseas student and physical attendance, inevitably affecting their revenue streams.

From a lenders perspective, many investment grade funds and commercial banks are also re weighting their balance sheets to correct their desired exposure to this market. This is based on the existing threats listed above. Developers risk has previously been reduced by mechanisms such as forward fund from institutions or nomination agreements and leases from universities.

What does this actually mean? Lending is underwritten on various factors of risk. Without forward funding and guaranteed future income from a lease, the credit risk significantly increases. The developers will have to build out the scheme with no clear exit or guaranteed income. Underwriting a loan and assessing the risk of the scheme will mean that more emphasis will be on the letting operation and management of the building on completion. Direct lets are speculative when looking at the value of a scheme and inevitably result in more stringent underwriting on end values. To realise the full value of the transaction, a longer stabilisation period will need to be considered.

To offset risk, credit teams are now looking for Section 73 planning amendments to allow the scheme to be presented as a multi-use scheme. Co-living is a good alternative use for this type of asset. This produces a second valuation in case the issues within the PBSA market materialise. Other important factors that are being more highly scrutinised are the fundamentals within the deal. Is the university part of the Russell Group? What is the financial strength of the University? What are the specialisms and do they require physical attendance? And finally, what is the ratio of students using HMOs vs PBSA within a location. If the former outweighs the latter, there is a material shortfall which will improve the risk for credit.

Whilst liquidity within the sector is currently low, we have seen fresh liquidity entering the market through specialist funds. These funds have PBSA expertise that can underwrite a deal on a granular level rather than a blanket approach on the sector. This matter is constantly evolving and it is certainly a more creative market but for the right deal there is still funding available.

Read the full article in Buisness Moneyfacts here.

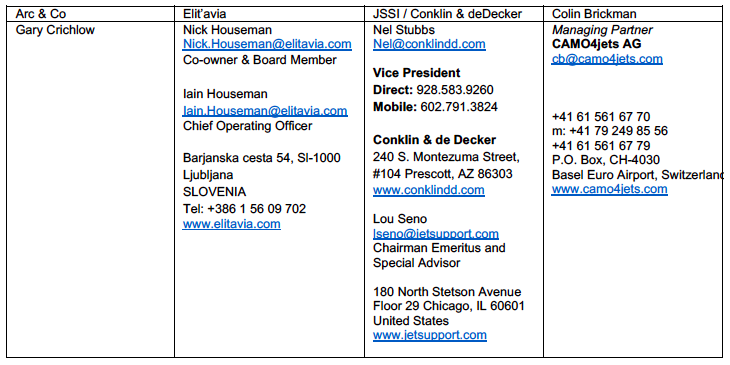

Managing the Costs of Aircraft Ownership

In the first of two articles for EVA Magazine, Arc & Co’s Director of Aviation Finance, Gary Crichlow, takes a look at the costs and financial considerations of aircraft ownership. Key industry experts also share their thoughts about managing the costs of ownership - saving you money, making your money work harder, and avoiding expensive mistakes.

Key industry experts that contributed to this article include:

Nick Houseman, co-owner and board member of operator Elit’avia

Nel Stubbs, Vice President at Conklin & de Decker

Colin Brickman, Managing Partner at Switzerland-based aviation technical advisory firm CAMO4jets

Lou Seno, Chairman Emeritus and Special Advisor at Jet Support Services Inc (JSSI)

Côme Charron, European Sales Director at aircraft broker Guardian Jet

Aviation Insight Series: It’s not working …PART 1

PART 1

… owning an aircraft is costing more than I thought it would. How can I achieve better value for money?

Running an aircraft is an expensive and complex proposition. The costs involved go far beyond the sticker price, no matter how fiercely it’s been bargained. To make matters worse, the sources of those costs vary widely and can be difficult to understand, let alone monitor. We strongly recommend these three steps to get a handle on your costs and extract maximum value for money.

1. Take the time to understand the lingo

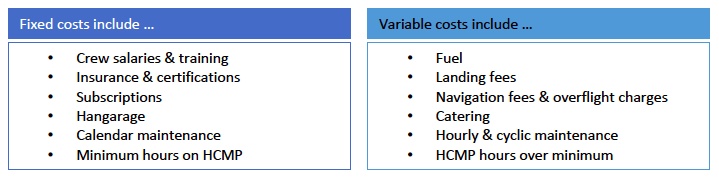

We asked Nick Houseman, Co-owner and board member of operator Elit’avia, to clarify how best to understand the plethora of aircraft-related costs. He advises “The costs can really be split into two categories: fixed costs that you pay whether you fly or not; and variable costs that are proportionate to how much you use the aircraft. There is some overlap, especially where maintenance is concerned. Some maintenance is calendar-based, and some is based on how much (hourly) and how frequently (cyclic) you fly. And where it gets really interesting is on hourly cost maintenance programmes (HCMPs) like Jet Support Services Inc (JSSI). These HCMPs usually have a minimum usage amount per year that you pay for whether you fly or not.”

2. Benchmark, benchmark, benchmark

Once you’ve understood how your costs accrue for your specific operation, a good next step is to benchmark them in an organised way. Benchmarking is, in fact, what should be done before you even parted with your cash for the aircraft – but we are where we are, and as they say, better late than never.

As Nel Stubbs, Vice President at Conklin & de Decker, a well-respected adviser on aircraft operating costs, explains: “We strongly recommend benchmarking against industry standards to ensure you’re getting value for money. It’s a good idea to look at the entire lifecycle of the aircraft and create a budget that captures all of your aircraft-related outgoings - including your tax exposure for the length of time you expect to own the aircraft. We constantly research costs for virtually every aircraft model, gathering cost data from aircraft manufacturers, maintenance facilities, independent vendors, as well as our parent company, JSSI, and publish our analysis in our Conklin & de Decker Reports. This kind of benchmarking analysis is the core of what we do.”

3. Beware of false economies

Armed with your benchmark analysis, you’re now in a much better and informed position to look at the costs arising from your specific aircraft usage. However, be careful. As part of a drive to extract maximum value for money, the most important rule is - beware of the false economy. Investing in the right level of expertise when it comes to aircraft finance, operation, or maintenance can seem like a pricey proposition up-front, but can pay off handsomely in the long-term in terms of saving time and avoiding expensive mistakes.

When it comes to extracting best value for money, your key ally is the operator of your aircraft. “A good operator can add a lot of value to the equation”, comments Iain Houseman at Elit’avia. “For example, knowing which facilities provide the best maintenance support at the best prices, or having a line of credit in place with major maintenance facilities and your aircraft’s manufacturer, so you are not stuck at two in the morning because a $500 bill is outstanding when you’re trying to depart. A quality operator will have pre-negotiated pricing for global fuel already in place so you get the best overall deal for your usage profile, and access to ground handlers who can ensure things run as smoothly as possible in parts of the world where facilities are limited.”

A prime example of where investing in expertise can lead to significant cost savings is when the aircraft undergoes major maintenance - either scheduled or due to unforeseen circumstances. We asked Colin Brickman, Managing Partner at Switzerland-based aviation technical advisory firm CAMO4jets for his perspective. His advice is:

“Whilst they may be an excellent flyer, don’t rely on your senior pilot to supervise a large maintenance project. That is, unless they have, in addition to their flying skills, the specific technical background and necessary experience to define the workscope and negotiate contract conditions with all the suppliers and maintenance providers. Bear in mind that maintenance companies are in the business of selling man-hours: you need a project manager with the requisite knowledge to agree labour rates and control man-hours, parts & materials sourcing and defect & repairs management. They also need the contractual nous to negotiate avenues of recourse should things go wrong or go over budget. It’s a tall order for anyone who doesn’t do this day in, day out as their primary job.”

Likewise, paying for maintenance coverage up-front may seem counter-intuitive, but can actually be a sound investment. Lou Seno, Chairman Emeritus and Special Advisor at Jet Support Services Inc (JSSI), concurs:

“The value of enrolling your aircraft onto an HCMP goes well beyond the predictable budget and protection from unscheduled maintenance repair costs that are key reasons for choosing this coverage. Aircraft owners also experience enhanced residual values when their asset is enrolled on a programme because the funds accrued are transferable with the aircraft to the new buyer. At JSSI, we even go one step further: an owner can opt to either transfer the programme funds when they sell (and get the benefit of the enhanced residual value), or they can keep their rights to the accrued maintenance reserves and apply them to JSSI coverage on their replacement aircraft – even if it’s a different make and model.”

Financiers also look more favourably on an enrolled aircraft because it mitigates their risk. This in turn leads to a simpler due diligence process on the aircraft, a more generous amortisation profile – which means lower financing repayments. For leased aircraft, there is the added benefit of simplified return conditions at the back end: rather than getting involved in long and complicated disputes over the aircraft’s maintenance condition, all you need to do is hand back the aircraft with the HCMP fully paid up and transferable.

And on the topic of financing: it is an oft-overlooked consideration when it comes to extracting the maximum benefit from your aircraft from a cost perspective. If your aircraft is currently unencumbered, then it may be worth exploring releasing equity and you can then deploy that cash into investments that earn a return to further strengthen your cash position.

“Financing is often dismissed as being too complex, too onerous or too invasive compared to the relative simplicity of using cash,”says Gary Crichlow, Director of Aviation Finance at Arc & Co. He goes on to comment: “But it needs to be seen as a practical way of putting cash to work in order to generate a return that improves your overall financial picture. This would be cash that, if it remained locked into the aircraft, would simply disappear with depreciation as the aircraft ages.”

If your aircraft is already financed, it can be worth shopping around for a better deal. “We advise our clients to consider all facets of their current financing arrangement to understand what their pain point is – whether it’s the current monthly payment, the balloon payable at maturity or the term remaining before it is due. We can help find and negotiate a deal that better fits their needs,” says Mr Crichlow.