Aviation Insight Series: It’s not working …PART 1

PART 1

… owning an aircraft is costing more than I thought it would. How can I achieve better value for money?

Running an aircraft is an expensive and complex proposition. The costs involved go far beyond the sticker price, no matter how fiercely it’s been bargained. To make matters worse, the sources of those costs vary widely and can be difficult to understand, let alone monitor. We strongly recommend these three steps to get a handle on your costs and extract maximum value for money.

1. Take the time to understand the lingo

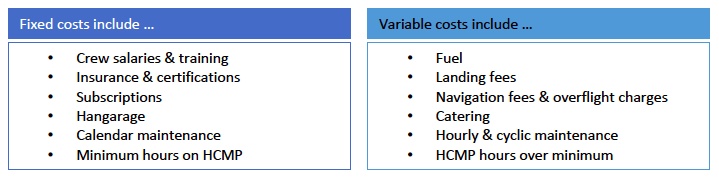

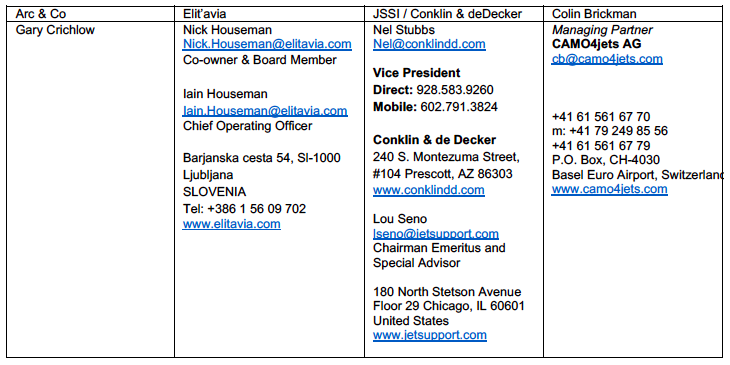

We asked Nick Houseman, Co-owner and board member of operator Elit’avia, to clarify how best to understand the plethora of aircraft-related costs. He advises “The costs can really be split into two categories: fixed costs that you pay whether you fly or not; and variable costs that are proportionate to how much you use the aircraft. There is some overlap, especially where maintenance is concerned. Some maintenance is calendar-based, and some is based on how much (hourly) and how frequently (cyclic) you fly. And where it gets really interesting is on hourly cost maintenance programmes (HCMPs) like Jet Support Services Inc (JSSI). These HCMPs usually have a minimum usage amount per year that you pay for whether you fly or not.”

2. Benchmark, benchmark, benchmark

Once you’ve understood how your costs accrue for your specific operation, a good next step is to benchmark them in an organised way. Benchmarking is, in fact, what should be done before you even parted with your cash for the aircraft – but we are where we are, and as they say, better late than never.

As Nel Stubbs, Vice President at Conklin & de Decker, a well-respected adviser on aircraft operating costs, explains: “We strongly recommend benchmarking against industry standards to ensure you’re getting value for money. It’s a good idea to look at the entire lifecycle of the aircraft and create a budget that captures all of your aircraft-related outgoings - including your tax exposure for the length of time you expect to own the aircraft. We constantly research costs for virtually every aircraft model, gathering cost data from aircraft manufacturers, maintenance facilities, independent vendors, as well as our parent company, JSSI, and publish our analysis in our Conklin & de Decker Reports. This kind of benchmarking analysis is the core of what we do.”

3. Beware of false economies

Armed with your benchmark analysis, you’re now in a much better and informed position to look at the costs arising from your specific aircraft usage. However, be careful. As part of a drive to extract maximum value for money, the most important rule is - beware of the false economy. Investing in the right level of expertise when it comes to aircraft finance, operation, or maintenance can seem like a pricey proposition up-front, but can pay off handsomely in the long-term in terms of saving time and avoiding expensive mistakes.

When it comes to extracting best value for money, your key ally is the operator of your aircraft. “A good operator can add a lot of value to the equation”, comments Iain Houseman at Elit’avia. “For example, knowing which facilities provide the best maintenance support at the best prices, or having a line of credit in place with major maintenance facilities and your aircraft’s manufacturer, so you are not stuck at two in the morning because a $500 bill is outstanding when you’re trying to depart. A quality operator will have pre-negotiated pricing for global fuel already in place so you get the best overall deal for your usage profile, and access to ground handlers who can ensure things run as smoothly as possible in parts of the world where facilities are limited.”

A prime example of where investing in expertise can lead to significant cost savings is when the aircraft undergoes major maintenance - either scheduled or due to unforeseen circumstances. We asked Colin Brickman, Managing Partner at Switzerland-based aviation technical advisory firm CAMO4jets for his perspective. His advice is:

“Whilst they may be an excellent flyer, don’t rely on your senior pilot to supervise a large maintenance project. That is, unless they have, in addition to their flying skills, the specific technical background and necessary experience to define the workscope and negotiate contract conditions with all the suppliers and maintenance providers. Bear in mind that maintenance companies are in the business of selling man-hours: you need a project manager with the requisite knowledge to agree labour rates and control man-hours, parts & materials sourcing and defect & repairs management. They also need the contractual nous to negotiate avenues of recourse should things go wrong or go over budget. It’s a tall order for anyone who doesn’t do this day in, day out as their primary job.”

Likewise, paying for maintenance coverage up-front may seem counter-intuitive, but can actually be a sound investment. Lou Seno, Chairman Emeritus and Special Advisor at Jet Support Services Inc (JSSI), concurs:

“The value of enrolling your aircraft onto an HCMP goes well beyond the predictable budget and protection from unscheduled maintenance repair costs that are key reasons for choosing this coverage. Aircraft owners also experience enhanced residual values when their asset is enrolled on a programme because the funds accrued are transferable with the aircraft to the new buyer. At JSSI, we even go one step further: an owner can opt to either transfer the programme funds when they sell (and get the benefit of the enhanced residual value), or they can keep their rights to the accrued maintenance reserves and apply them to JSSI coverage on their replacement aircraft – even if it’s a different make and model.”

Financiers also look more favourably on an enrolled aircraft because it mitigates their risk. This in turn leads to a simpler due diligence process on the aircraft, a more generous amortisation profile – which means lower financing repayments. For leased aircraft, there is the added benefit of simplified return conditions at the back end: rather than getting involved in long and complicated disputes over the aircraft’s maintenance condition, all you need to do is hand back the aircraft with the HCMP fully paid up and transferable.

And on the topic of financing: it is an oft-overlooked consideration when it comes to extracting the maximum benefit from your aircraft from a cost perspective. If your aircraft is currently unencumbered, then it may be worth exploring releasing equity and you can then deploy that cash into investments that earn a return to further strengthen your cash position.

“Financing is often dismissed as being too complex, too onerous or too invasive compared to the relative simplicity of using cash,”says Gary Crichlow, Director of Aviation Finance at Arc & Co. He goes on to comment: “But it needs to be seen as a practical way of putting cash to work in order to generate a return that improves your overall financial picture. This would be cash that, if it remained locked into the aircraft, would simply disappear with depreciation as the aircraft ages.”

If your aircraft is already financed, it can be worth shopping around for a better deal. “We advise our clients to consider all facets of their current financing arrangement to understand what their pain point is – whether it’s the current monthly payment, the balloon payable at maturity or the term remaining before it is due. We can help find and negotiate a deal that better fits their needs,” says Mr Crichlow.