Arc & Co. Privacy Notice

Who we are:

We are Arc & Co. and we can be contacted using the following details:

Telephone Number: +44 (0)20 3205 2120

Address: 60-62 Margaret Street, London, W1W 8TF

Email address: enquiries@arcandco.com

Data Protection Officer/ contact: Andrew Robinson

ICO Registration Number: ZA163502

Our legal grounds for holding your data:

The UK’s data protection laws allow us to use your personal data provided we have a lawful basis to do so. This includes sharing it in certain circumstances, as described below.

We consider we have the following reasons (legal bases) to use your personal data:

Performance of contract with you: we need to use your personal data to be able to successfully legally contract with you.

Compliance with our legal obligations: we need to use your personal data so as to comply with certain legislation such as financial crime legislation.

Legitimate interests: these are our business and commercial reasons for using your data, which we have balanced against your interests. We have certain legitimate interests in using your data which are not outweighed by your interests, fundamental rights or freedoms. These legitimate interests are to help prevent and detect financial crime, fraud and money laundering, to promote responsible lending, to support our tracing, collection and litigation procedures and to assist our compliance with the legal and regulatory requirements placed upon us.

Your consent: You can withdraw this consent at any time, in which case we will cease to use it, unless we have a right and a need to continue processing it for one of the other reasons set out above.

More information on how we use your personal data and for what purposes is set out below.

What data do we collect?

Data provided by you:

Funder application details: for example but not limited to, your name, national insurance number, postal address, your email address, your IP address, telephone numbers, date of birth, bank account details, equipment requirement details, home ownership details, reason for borrowing, your assets and liabilities, details of your proof of identity documentation, proof of address documentation, evidence of additional equity available and evidence of any other business interests

When you talk to us: for example on the phone, or in person including call recordings and voice messages. We may monitor or record calls with you to check we have carried out your instructions, to resolve queries or disputes, to improve the quality of our service or for regulatory or fraud prevention purposes

In writing: for example letters, emails, texts and other electronic communications

Online: for example when you use our website or mobile app

In financial reviews, for renewals and in any surveys etc

Data we collect when you use our services?

· Transaction data: for example what sort of products you are selecting, the length of term, the types of asset you are looking at financing, business type and geographical location

· Payment data: for example, the amount, origin, frequency, history and method of your payments

· Usage and profile data: for example, the profile you create to use our website and mobile app and how you use it. We gather this data from the devices you use, using cookies and other software

· Register online or other communication methods for our services.

· Voluntarily complete a customer survey or provide feedback on any of our message boards or via email.

· Use or view our website via your browser’s cookies.

Data provided to and by third parties

Data from persons that introduce you to us: for example brokers, product suppliers, financial advisers, agents, finance providers or other third parties

Data from credit reference agencies, most likely to be either Experian, Creditsafe, Equifax or CallCredit

Data from fraud prevention agencies

Publicly available information: for example, from the land registry, companies house, the electoral register, other information available online or in the media, including social media

Data from your representatives where relevant: for example your legal and financial advisers such as lawyers and accountants*

Data from your employers*

**We may also require a statement signed by an independent qualified accountant as to your financial worth which may include information such as your gross and net worth, your assets and liabilities and information as to your available collateral or security. You will be asked to consent to the provision of this information

Special Category Data

In the course of your interactions with Arc & Co. you may share information that is classified as ‘Special Category Data’. This could include data about:

· Race

· Ethnic origin

· Politics

· Religion

· Trade union membership

· Genetics

· Biometrics

· Health

· Sex life

· Sexual orientation

Where you do share information relating to any of these categories e.g., when you may share information about your health or a characteristic of vulnerability Arc & Co. will always seek explicit consent from you to store and process such information.

Why is personal data collected by us

Arc & Co. collect personal data for a number of reasons

From time to time, we may contact you to ask for your consent to use your personal data for other purposes. Your personal data may also be used for other purposes where required or permitted by law.

When we and fraud prevention agencies process your personal data, we do so on the basis that we have a legitimate interest in preventing fraud and money laundering, and to verify identity, in order to protect our business and to comply with laws that apply to us. Such processing is also a contractual requirement of the services or financing you have requested. We, and fraud prevention agencies, may also enable law enforcement agencies to access and use your personal data to detect, investigate and prevent crime. Fraud prevention agencies can hold your personal data for different periods of time, and if you are considered to pose a fraud or money laundering risk, your data can be held for up to six years.

In order to process your application, we may supply your personal information to credit reference agencies (CRAs) in which case they will give us information about you, such as about your financial history. We do this to assess your creditworthiness and product suitability, check your identity, manage your account, trace and recover debts and prevent criminal activity. When CRAs receive a search from us they may place a search footprint on your credit file that may be seen by other lenders and used to assess applications for finance from you and members of your household. The CRA may also share your personal information with other organisations. We may also continue to exchange information about you with CRAs on an ongoing basis, including about your settled accounts and any debts not fully repaid on time. CRAs will share your information with other organisations. Your data will also be linked to the data of your spouse, any joint applicants or other financial associates. We can provide you with the identities of the CRAs and the ways in which they use and share personal information upon your request.

From time to time, we may provide your information to our partners, third parties and customer service agencies for research and analysis purposes so that we can monitor and improve the services (or as the case may be) we provide. We may contact you by post, e-mail or telephone (or as required) to ask you for your feedback and comments on our services (or as the case may be).

We may also contact you about our other goods or services that may be of interest to you.

How will we use your data?

Our Company collects your data so that we can:

· Process your application and manage your request.

· Email you with special offers on other products and services we think you might like.

· To monitor the performance of our products and services to ensure consumer outcomes are being achieved

What do we mean by “Your Personal Data”?

Your Personal Data means any information that describes or relates to your personal circumstances. Your Personal Data may identify you directly, for example your name, address, date or birth, National Insurance number. Your Personal Data may also identify you indirectly, for example, your employment situation, your physical and mental health history, or any other information that could be associated with your cultural or social identity.

In the context of providing you with assistance in relation to your Mortgage and other Finance requirements Your Personal Data may include:

Title, names, date of birth, gender, nationality, civil/marital status, contact details, addresses and documents that are necessary to verify your identity

Employment and remuneration information, (including salary/bonus schemes/overtime/sick pay/other benefits), employment history

Bank account details, tax information, loans and credit commitments, personal credit history, sources of income and expenditure, family circumstances and details of dependents

Health status and history, details of treatment and prognosis, medical reports (further details are provided below specifically with regard to the processing we may undertake in relation to this type of information)

Any pre-existing Mortgage, Finance and Insurance products and the terms and conditions relating to these

The basis upon which our Firm will deal with Your Personal Data

When we speak with you about your mortgage or other finance requirements, we do so on the basis that both parties are entering a contract for the supply of services.

In order to perform that contract, and to arrange the products you require, we have the right to use Your Personal Data for the purposes detailed below.

Alternatively, either in the course of initial discussions with you or when the contract between us has come to an end for whatever reason, we have the right to use Your Personal Data provided it is in our legitimate business interest to do so and your rights are not affected. For example, we may need to respond to requests from mortgage lenders or other financial companies which provide the services you require and our Compliance Service Provider relating to the advice we have given to you, or to make contact with you to seek feedback on the service you received.

On occasion, we will use Your Personal data for contractual responsibilities we may owe our regulator the Financial Conduct Authority (FCA), or for wider compliance with any legal or regulatory obligation to which we might be subject.

In such circumstances, we would be processing Your Personal Data in order to meet a legal, compliance or other regulatory obligation to which we are subject.

The basis upon which we will process certain parts of Your Personal Data

If you have parental responsibility for children under the age of 13, it is also very likely that we will record information on our systems that relates to those children.

The arrangement of loans may involve disclosure by you to us of information relating to historic or current criminal convictions or offences (together “Criminal Disclosures”). This is relevant to insurance related activities such as underwriting, claims and fraud management. We will ask your permission to process Criminal Disclosures where these are applicable to secure the services you require.

We will use Criminal Disclosures in the same way as Your Personal Data generally, as set out in this Privacy Notice.

Information on Criminal Disclosures must be capable of being exchanged freely between our Firm and other financial companies to enable customers to secure the services they require.

When Personal Data is shared

Your personal data may be used by our partners, lenders, brokers, agents, sub-contractors, lawyers and by any of our or their subsidiary or associated companies before, during and after your agreement facilitated by us. We may also use organisations to perform tasks on our behalf including information technology service providers, repossession agents, banks and transportation companies who we will then be sharing your personal data with and who may also process and retain your data both before, during and after your agreement facilitated by us. Any of these third parties may contact you by post, e-mail or telephone (or as required).

We may also share your personal data with CRAs, fraud prevention agencies, law enforcement agencies, regulators and other authorities, the UK Financial Services Compensation Scheme, any agent that you have given us authority to communicate with and persons you ask us to share your data with, companies that we introduce you to, market researchers tracing and debt recovery agencies and customer service agencies for the purposes set out above. These agencies and firms may also share your personal data with others.

Your personal data may also appear on the V5, service history, manufacturers record, insurance documentation or within receipts in relation to the asset which may be shared by us with third parties who store, transport, advertise, sell, express interest in purchasing, own or later hire the asset.

If, in the future, we sell, transfer or merge all or part of our business or assets, including the acquisition of other businesses, we may share your data with other parties. We will only do this if they agree to keep it safe and private and to only use it in the same ways as set out in this notice.

What are your data protection rights and choices?

Your personal data is protected by legal rights, which include:

Right to be informed – Individuals have the right to be informed about the collection and use of their personal data

The right of access to your personal data – Individuals have the right to access and receive a copy of their personal data and other supplementary information.

The right to rectification- Individuals have the right to have inaccurate personal data rectified or completed if incomplete.

The right to erasure – Individuals have the right to have their personal data erased.

The right to restrict processing – Individuals have the right to request the restriction or suppression of their personal data.

The right to portability – This allows individuals to obtain and reuse their personal data for their own purposes across different services.

The right to object – this gives individuals the right to object to the processing of their personal data in certain circumstances, it also gives individuals the absolute right to stop their data being used for direct marketing

The right in relation to automated decision making and profiling – this allows individuals to object to their data being used in an automated individual decision-making process (making a decision solely by automated means without any human involvement) and profiling (automated processing of personal data to evaluate certain things about an individual). Profiling can be part of an automated decision-making process.

There may be reasons why we need to keep or use your data, but please tell us if you think we should not be processing your data.

If you make a request, we have one month to respond to you. If you would like to exercise any of these rights, please contact us at our email enquiries@arcandco.com

For further information on how your information is used, how we maintain the security of your information and your rights in relation to it, please contact us via email enquiries@arcandco.com or call us on +44 (0)20 3205 2120

How long is your data kept

We will retain your personal data as long as you are a customer with us. We may retain your personal data beyond this date for the purposes mentioned above and will in any case at all times retain your personal data for the minimum period required by law. We may also retain your data to deal with any disputes, to maintain records and to show we have dealt with you fairly.

We may also retain your data for research and statistical purposes in which case we will ensure it is kept private and used only for these purposes.

Data about live and settled accounts is kept on credit files for six years from the date they’e settled or closed. If the account is recorded as defaulted, the data is kept for six years from the date of the default.

Marketing

Arc & Co. understands that with the introduction of the Consumer Duty, it is likely the level of communications issued by our business will increase. This will be necessary to support customers to understand the products and services offered and to provide support to customer throughout the lifecycle of the relationship.

Our Company would like to send you information about products and services of ours that we think you might like, as well as those of our partner companies.

If you have agreed to receive marketing, you may always opt out at a later date.

You have the right at any time to stop Arc & Co. from contacting you for marketing purposes.

Cookies

Please read this cookie policy carefully as it contains important information on who we are and how we use cookies on our website. This policy should be read together with our Customer Privacy Notice https://www.arcandco.com/privacy which sets out how and why we collect, store, use and share personal information generally, as well as your rights in relation to your personal information and details of how to contact us and supervisory authorities if you have a complaint.

Who we are

This website is operated by Arc & Co. Structured Finance Limited also known as Arc & Co. We are an independent and privately-owned specialist debt advisor.

Our website

This cookie policy relates to your use of our website, https://www.arcandco.com. Our website uses cookies to distinguish you from other users of our website. This helps us to provide you with a good experience when you browse our website and also allows us to improve our site.

Cookies

A cookie is a small file of letters and numbers that we store on your browser or the hard drive of your computer if you agree. Cookies contain information that is transferred to your computer's hard drive.

We use the following cookies:

Strictly necessary cookies These are cookies that are required for the operation of our website. They include, for example, cookies that enable you to log into secure areas of our website, use a shopping cart or make use of e-billing services.

Analytical or performance cookies These allow us to recognise and count the number of visitors and to see how visitors move around our website when they are using it. This helps us to improve the way our website works, for example, by ensuring that users are finding what they are looking for easily.

Functionality cookies These are used to recognise you when you return to our website. This enables us to personalise our content for you, greet you by name and remember your preferences (for example, your choice of language or region).

For further information on our use of cookies, including a detailed list of your information which we and others may collect through cookies, please see below.

For further information on cookies generally, including how to control and manage them, visit https://allaboutcookies.org/.

Consent to use cookies and changing settings

We will ask for your consent to place cookies or other similar technologies on your device, except where they are essential for us to provide you with a service that you have requested.

You can withdraw any consent to the use of cookies or manage any other cookie preferences following the instructions below. It may be necessary to refresh the page for the updated settings to take effect.

Our use of cookies

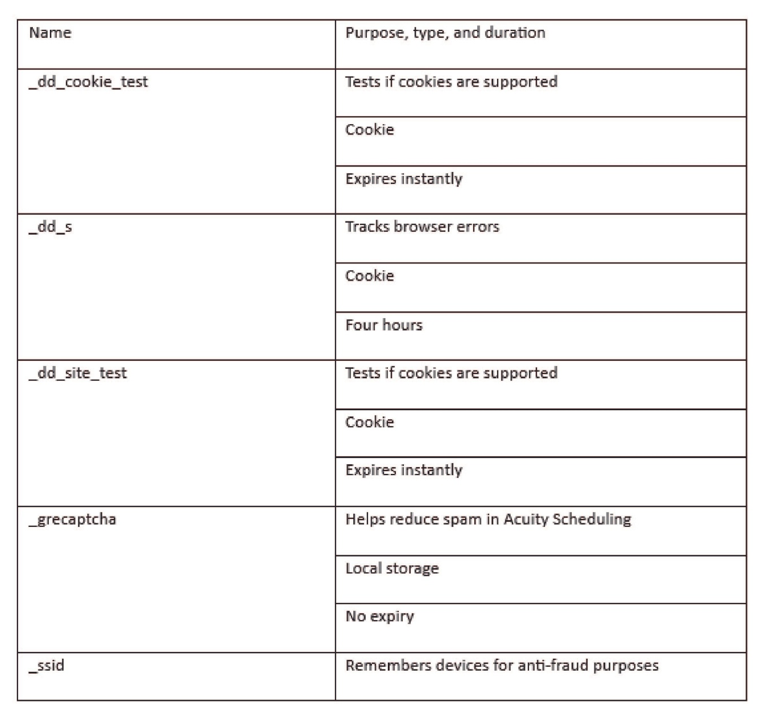

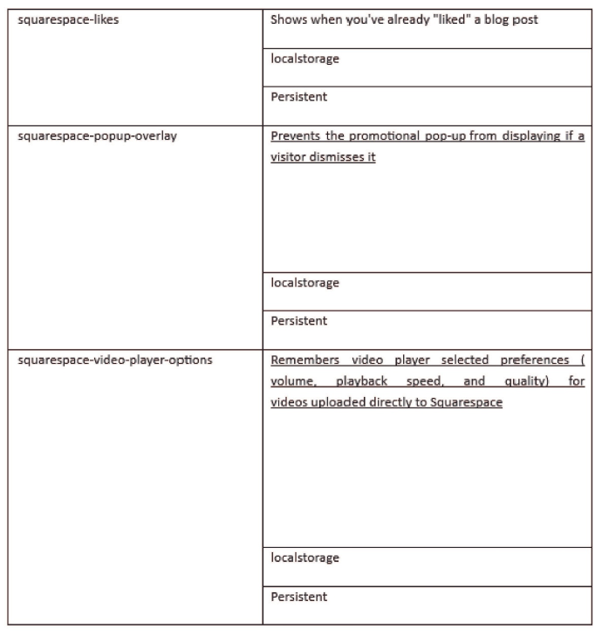

The table below provides more information about the cookies we use and why:

Functional and required cookies

We use some necessary cookies so visitors can navigate and use key features on our site.

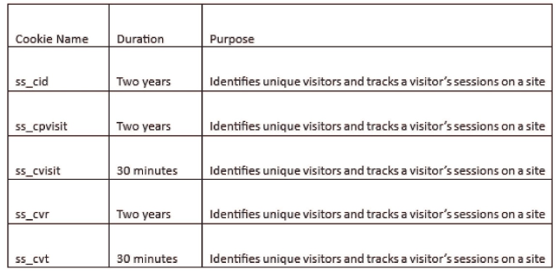

Analytics and performance cookies

We use analytics and performance cookies to collect information on your behalf about how visitors interact with our site. Storing these cookies is how we populate data such as traffic sources, unique visitors, and cart abandonment.

You can disable analytics and performance cookies at any time.

How to turn off all cookies and the consequences of doing so

If you do not want to accept any cookies, you may be able to change your browser settings so that cookies (including those which are essential to the services requested) are not accepted. If you do this, please be aware that you may lose some of the functionality of our website.

For further information about cookies and how to disable them please go to www.allaboutcookies.org.

Changes to this policy

This policy was published on 10th September 2025.

Privacy policies of other websites

Arc & Co’s website contains links to other websites. If you click on a link to another website, our privacy policy no longer applies, and we recommend you review that sites privacy policy to establish how they will process your data.

Changes to our privacy policy

Our Company keeps its privacy policy under regular review and places any updates on this web page. This privacy policy was last updated on 28/02/2025.

How to contact us

If you have any questions about Our Company’s Privacy Policy, the data we hold on you, or you would like to exercise one of your data protections rights, please do not hesitate to contact us.

Email us at: enquiries@arcandco.com

Call us: +44 (0)20 3205 2120

Or write to us at: 60-62 Margaret Street, London, W1W 8TF

How to make a complaint and contact the appropriate authority

If you are unhappy about how your personal data has been used by us, please contact us and we will be happy to register a complaint.

You also have a right to complain to the Information Commissioner’s Office which regulates the processing of personal data. You can contact them at Information Commissioner’s Office, Wycliffe House, Water Lane, Wilmslow, Cheshire, SK9 5AF, on 0303 123 1113 or by email to casework@ico.org.uk. See also https://ico.org.uk/global/contact-us/.

Authorised and Regulated by the Financial Conduct Authority

The guidance and/or advice contained in within this website is subject to the UK regulatory regime, and is therefore targeted at customers based in the UK

Registered Office

Unit 4D, Lansbury Business Estate, 102 Lower Guildford Road, Knaphill, Woking, Surrey GU21 2EP, company number 7706624.

Arc & Co. Structured Finance Ltd t/a Arc & Co.

60-62 Margaret Street, London,

W1W 8TF

Company Number: 07113060

Registered address: Unit 4D, Lansbury Business Estate, 102 Lower Guildford Road, Knaphill, Woking, Surrey GU21 2EP

Arc & Co. Structured Finance Ltd t/a Arc & Co.

60-62 Margaret Street, London,

W1W 8TF

Company Number: 7706624

Registered address: Unit 4D, Lansbury Business Estate, 102 Lower Guildford Road, Knaphill, Woking, Surrey GU21 2EP